When was the last time you encountered fake honey?

If honey is the third most targeted product for fraud and adulteration, and you haven't come across any while shopping, is it because there are no counterfeit honeys in our local market or because these fake products are extremely convincing? As a beekeeper, you have the expertise to differentiate syrup from honey, but what about the average consumer? And what about fraudulent products? Does that jar really contain citrus honey?

The demand for honey on a global scale has significantly increased in recent decades, with global honey exports doubling from 373,000 tonnes in 2004 to 751,000 tonnes in 2022. Most countries are unable to meet their consumers' demand through local production, so they rely on imported honey to fill the gap. This is especially true for the South African market, which has become dominated by imports.

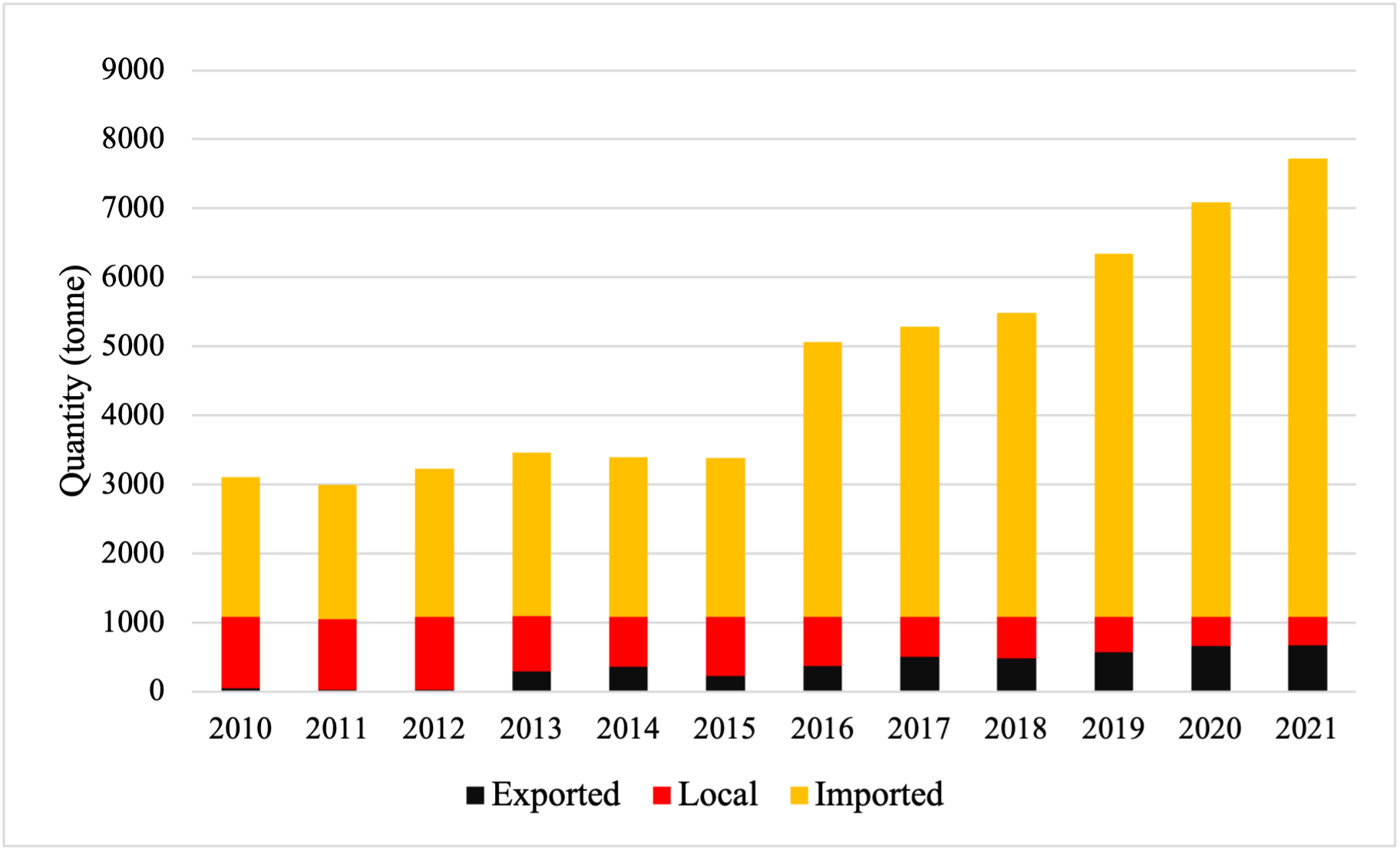

Local honey production has remained stable since 2010, with official production at just over 1000 tonnes. In 2010, imported honey accounted for 65% of the South African market, and by 2021, this number had increased to 86%. This suggests that the growing demand for honey seen in the international market is also evident in the South African market, and likewise, South African producers are unable to meet the rising demand of local consumers.

Figure 1:

Naturally, the increased global demand was accompanied by a worldwide increase in honey production, but the volumes produced were puzzling, to say the least. One study revealed that globally, the number of beehives increased by 8% between 2007 and 2014, but there was a disproportionate 61% increase in the volume of honey produced during the same period. While factors such as improved beekeeping practices and more efficient production methods have contributed to this increase, they cannot fully explain the massive surge in honey production. Unfortunately, the likely explanation for this increase has been attributed to the growing prevalence of adulterated and counterfeit "honeys".

Adulterated and fraudulent products pose a significant threat to the global honey industry due to the economic strain they place on local producers and the health risks associated with these fake products. These counterfeit honeys are usually cheaper than authentic ones because of how they are "produced," which also results in them lacking the desired characteristics such as distinctive tastes and aromas, medicinal properties, and authentic sugar profiles. In some cases, these fake products are not honey at all but rather inexpensive syrups that are shamelessly sold as pure honey.

Despite these challenges, significant efforts have been made internationally to develop benchmarks to reduce the presence of adulterated and fraudulent honey products in the market. The Codex Alimentarius provides several standards to ensure the authenticity of honey, and the topic of honey authenticity is well-studied and regularly reviewed in academia. A crucial research priority globally is the development of national benchmarks to account for regional variations in honey properties that cannot be addressed at an international level. For example, the Codex Alimentarius states that the moisture content of honey should not exceed 20%, except for heather (Calluna) honey, which may have a moisture content of up to 23%. Similarly, variations in sugar content are allowed for certain authentic types of honey. A number of countries, including South Africa most recently, have initiated the development of tailored national benchmarks. While South Africa has standards for honey authentication, specific benchmarks for the natural variation of locally produced honey are still being developed.

Figure 1 highlights two important points for the South African honey industry. Firstly, there is a growing local demand for honey, and the current deficit is being met by increasing imports. The re-export volume of honey from South Africa is negligible, indicating that the imported honey is consumed locally. This unmet demand presents an opportunity for more local beekeepers to enter the market if consumers prioritize purchasing local products over imported honey. However, it is important to note that this shift in consumer behavior will not happen overnight.

The great news is that studies have been conducted on how the public perceives honey and what influences their buying behavior. One study discovered that consumers prefer locally produced honey over products with unknown origins after learning about honey adulteration, fraud, transhipping (also known as "honey-laundering"), and the potential health risks associated with poorly regulated products. Consumers have expressed willingness to pay more for locally produced honey if they can be assured that these products are authentic and safe to consume.

The absence of tailored legislation for verification is also a hurdle for the second insight highlighted in Figure 1, which is the demand for South African honey in the international market. The gradual increase of local honey exports (1-9%) from 2010 to 2021 indicates that there is interest in South African honey internationally. However, due to the prevalence of fraudulent and adulterated products globally, it is extremely difficult, if not impossible, to export honey without proper authenticity verification. The lack of local benchmarks to authenticate South African honey means that international markets remain inaccessible to South African producers.

It is clear that prioritizing the development of more comprehensive national benchmarks for South African honey would be profitable. In the past decade, research interest in South African honey has grown, with a focus on authenticating honey through its physical and chemical properties. The general consensus is that the honey available on the South African market is authentic and compliant with the available national regulations. One study also highlighted the therapeutic potential of South African honey as antimicrobial agents and their potential use in complex wound treatment.

Melissopalynology, the study of pollen and spores trapped in honey, has recently become a point of interest in South Africa. This field of research can be used to authenticate honey, specifically in detecting fraudulent products. The pollen and spores in honey have distinct size, shape, and other structural features (Figure 2) that allow scientists to make inferences about the honey's authenticity. The bees collect nectar and pollen from various plants, with the pollen identifiable to a varying level of accuracy. Pollen is a useful indicator of nectar composition in honey because it is the nectar, mixed with honeybees' saliva, that gives honey its unique taste, smell, and properties. The composition of pollen is used to determine the botanical (type of plants) and geographical (location) origins of honey. The botanical origin classifies honey as either monofloral, such as Citrus or Eucalyptus honey, or multifloral, such as Wildflower honey. The geographical origin provides information about where the honey was harvested and the surrounding environment. Recently, there has been a growing interest in melissopalynological research in South Africa. Studies have analyzed honey from the Greater Kruger National Park (Limpopo) and the Greater Cape Floristic Region (GCFR) (Western and Northern Cape).

The development of melissopalynological research in South Africa is promising for honey legislation because it is one of the most accurate methods for identifying different types of honey. Once the origin of a honey is verified, complementary analyses can be conducted to determine its physical and chemical properties. This information can then be used to inform policy changes and establish local honey verification procedures. Establishing routine verification would help build consumers' trust in the authenticity of local honey and bring local producers closer to selling their honey internationally. If the market for New Zealand’s famed Manuka (Leptospermum scoparium) honey is any indication, authentic Fynbos or Namaqualand honey could command a premium overseas.